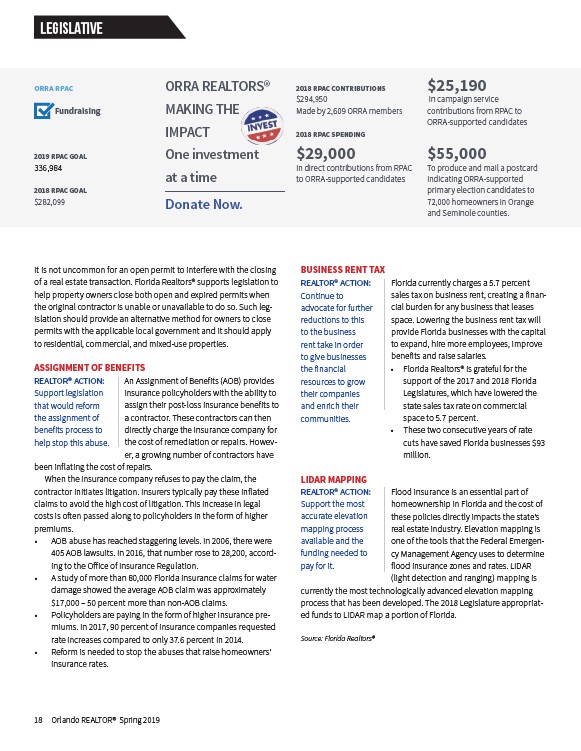

$25,190

In campaign service

contributions from RPAC to

ORRA-supported candidates

$55,000

To produce and mail a postcard

indicating ORRA-supported

primary election candidates to

72,000 homeowners in Orange

and Seminole counties. Donate Now.

It is not uncommon for an open permit to interfere with the closing

of a real estate transaction. Florida Realtors® supports legislation to

help property owners close both open and expired permits when

the original contractor is unable or unavailable to do so. Such legislation

should provide an alternative method for owners to close

permits with the applicable local government and it should apply

to residential, commercial, and mixed-use properties.

ASSIGNMENT OF BENEFITS

An Assignment of Benefits (AOB) provides

insurance policyholders with the ability to

assign their post-loss insurance benefits to

a contractor. These contractors can then

directly charge the insurance company for

the cost of remediation or repairs. However,

a growing number of contractors have

been inflating the cost of repairs.

When the insurance company refuses to pay the claim, the

contractor initiates litigation. Insurers typically pay these inflated

claims to avoid the high cost of litigation. This increase in legal

costs is oft en passed along to policyholders in the form of higher

premiums.

• AOB abuse has reached staggering levels. In 2006, there were

405 AOB lawsuits. In 2016, that number rose to 28,200, according

to the Off ice of Insurance Regulation.

• A study of more than 80,000 Florida insurance claims for water

damage showed the average AOB claim was approximately

$17,000 – 50 percent more than non-AOB claims.

• Policyholders are paying in the form of higher insurance premiums.

In 2017, 90 percent of insurance companies requested

rate increases compared to only 37.6 percent in 2014.

• Reform is needed to stop the abuses that raise homeowners’

insurance rates.

BUSINESS RENT TAX

Florida currently charges a 5.7 percent

sales tax on business rent, creating a financial

burden for any business that leases

space. Lowering the business rent tax will

provide Florida businesses with the capital

to expand, hire more employees, improve

benefits and raise salaries.

• Florida Realtors® is grateful for the

support of the 2017 and 2018 Florida

Legislatures, which have lowered the

state sales tax rate on commercial

space to 5.7 percent.

• These two consecutive years of rate

cuts have saved Florida businesses $93

million.

LIDAR MAPPING

Flood insurance is an essential part of

homeownership in Florida and the cost of

these policies directly impacts the state’s

real estate industry. Elevation mapping is

one of the tools that the Federal Emergency

Management Agency uses to determine

flood insurance zones and rates. LIDAR

(light detection and ranging) mapping is

currently the most technologically advanced elevation mapping

process that has been developed. The 2018 Legislature appropriated

funds to LIDAR map a portion of Florida.

Source: Florida Realtors®

LEGISLATIVE

ORRA RPAC

Fundraising

2019 RPAC GOAL

336,984

2018 RPAC GOAL

$282,099

ORRA REALTORS®

MAKING THE

IMPACT

One investment

at a time

2018 RPAC CONTRIBUTIONS

$294,950

Made by 2,609 ORRA members

2018 RPAC SPENDING

$29,000

In direct contributions from RPAC

to ORRA-supported candidates

REALTOR® ACTION:

Continue to

advocate for further

reductions to this

to the business

rent take in order

to give businesses

the financial

resources to grow

their companies

and enrich their

communities.

REALTOR® ACTION:

Support legislation

that would reform

the assignment of

benefits process to

help stop this abuse.

REALTOR® ACTION:

Support the most

accurate elevation

mapping process

available and the

funding needed to

pay for it.

18 Orlando REALTOR® Spring 2019